2024 Preventive Care Coverage Changes

Starting 2024, the Affordable Care Act (ACA) requires that your health insurance plans cover certain preventive care services for free, without deductibles, copays, or coinsurance. This applies to all adults, women, and children, and includes new coverage for anxiety and depression screening, HIV screening for older teens, and breastfeeding supplies. Make sure your plans are updated and ready to cover these services at no cost to employees. If you offer self-funded plans, double-check that they’re compliant with the new rules. Remember, even if your plan doesn’t cover pregnancy for dependents, they should still be able to access free preventive care related to pregnancy.

Reminder: Review Your Life Insurance Imputed Income

Key points for employers:

- Group term life insurance over $50,000: Employees pay tax on the extra amount (see IRS Table I). This applies if you pay any part of the premium.

- Key employees: If they get more favorable coverage, the entire value (not just over $50,000) is taxed. Key employees include high earners, certain shareholders, and retired key employees.

- Voluntary or supplemental employee-paid life: Employees pay tax on the difference between what they pay and the IRS Table I rate if:

- Some employees pay more and others pay less than the Table I rate.

- They pay for coverage with pre-tax salary reductions.

- Dependent life insurance:

- Employees must pay the full cost after-tax (no tax benefit).

- If you contribute, employees pay tax on the entire value over $2,000 unless it’s very small (“de minimis”).

Action steps:

- Check if your plan is “carried” by you (see above).

- Check if it favors key employees.

- Confirm your payroll system calculates taxes correctly.

- Ensure imputed income is included in employees’ W-2s (Boxes 1, 3, 5, and 12 with code C).

IBX & AmeriHealth Changes to Obesity Management

Independence Blue Cross (IBX) and AmeriHealth are implementing changes to obesity management, introducing new options for self-funded groups. Recognizing the heightened health risks associated with obesity, the coverage includes weight loss medications, bariatric surgery, and preventive care services for eligible members. However, the surge in the use of costly weight loss medications, such as glucagon-like peptide-1 (GLP-1) products, requires strategic management to control prescription costs.

For fully insured members, starting January 1, 2024, IBX will update coverage policies. To qualify for weight loss drug coverage, members must have a body mass index (BMI) over 30kg/m2 or over 27kg/m2 with an obesity-related comorbidity. Additionally, completion of a six-month lifestyle management program is mandatory. The medications must be taken as prescribed, with reauthorization required every six months.

Self-funded groups have new options effective 2024. Clients with the Standard Weight Loss Rider can maintain current coverage. Those on the Select or Value formularies are encouraged to consider the Highly Managed option, while Premium formulary clients can explore the Risk Managed option. Both alternatives have stringent criteria, excluding GLP-1 medications from rebates and introducing administration fees. Select and Premium formulary customers have the flexibility to activate these options at any time.

To communicate these changes effectively, impacted members will receive letters outlining adjustments to prior authorization requirements. The overarching goal is to support members in achieving sustainable weight loss while ensuring affordable healthcare for all.

Tower Health is Now Out-Of-Network for Cigna

Attention employers with Cigna insurance: recent contract negotiations between Cigna Healthcare and Tower Health, a major Pennsylvania hospital network, have reached an impasse. Effective January 1st, 2024, Tower Health facilities are no longer considered in-network for Cigna members. This means potential out-of-network costs for care received at Tower Health hospitals and clinics.

While Cigna remains committed to reaching a mutually beneficial agreement, they’ve expressed concern about Tower Health’s demand for significantly higher reimbursement rates, ultimately driving up healthcare costs for all parties involved. To minimize disruption for their members, Cigna is readily assisting Tower Health patients in finding alternative in-network providers nearby.

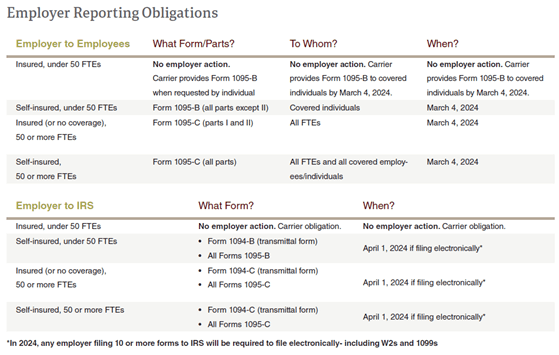

Compliance Corner: 2023 Employer Reporting Requirements

- Health insurers and self-insured plan sponsors report on the Minimum Essential Coverage (MEC) individuals had (Form 6055/1094-B/1095-B).

- Applicable Large Employers (ALEs) report on health coverage offered to full-time employees (Form 6056/1094-C/1095-C). These reports help enforce the Individual and Employer Mandates.

Rob is an employee benefits expert with over 25 years of experience. He is the founder and principal of Precision Benefits Group, a leading provider of corporate benefits plans. He is a member of the Philadelphia Business Journal Leadership Trust and regularly contributes to the publication.