Self-Funded Health Plans

What is a Self-Funded Health Plan?

Self-funded health plans (also known as Self-insured health plans) have recently become a popular option in the employee benefits industry. Originally, it was only sought after by employers with 500+ employees, but in recent years, smaller employers have opted into self-funded health plans to take advantage of the cost-saving and flexibility benefits that it offers.

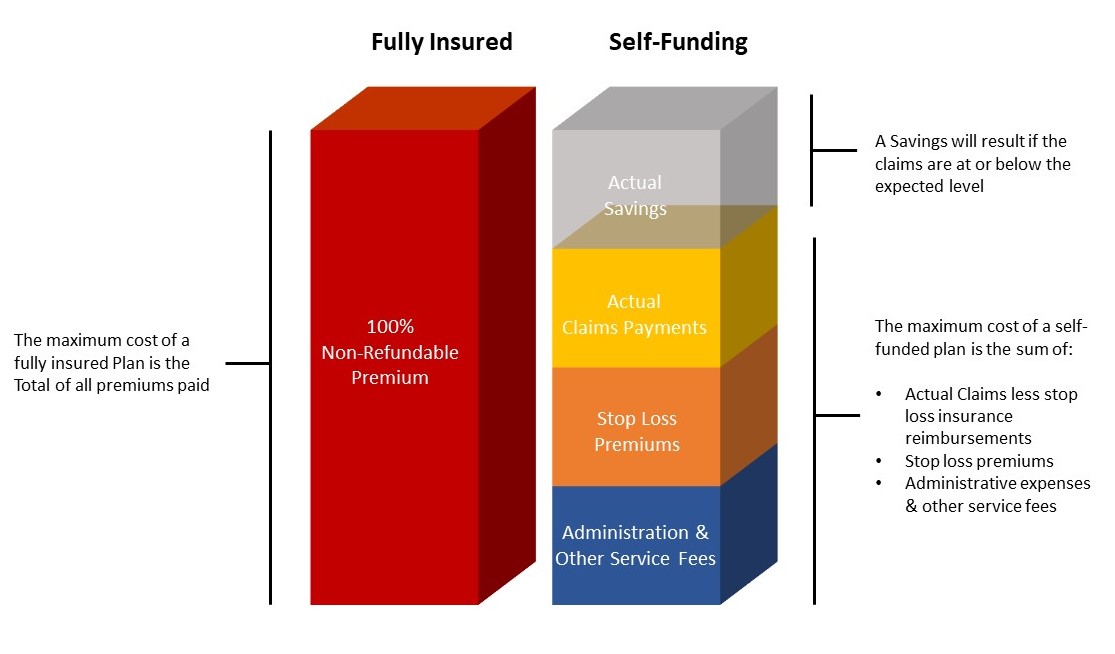

When a company decides to self-insure, they forego paying insurance company premiums in return for healthcare and managing their own claims with protection of a stop-loss policy to cover large or catastrophic claims.

Most self-funded health plan strategies can also be coupled with reference based pricing (RBP), which is a cost containment strategy that allows employers to set a pricing cap on what they pay for medical services. RBP provides greater cost transparency, allowing the employer to have more control over healthcare costs.

Our Precision Benefits Group team is well-versed in the strategies and different types of self-funded health plans. We can be a knowledgeable partner in your transition from a fully-insured health plan.

Contact us to see how a self-funded health plan or level (or hybrid) funded plan could benefit your company!

What is Hybrid-Funding?

Hybrid-funding (or Level-funding) is known as a self-funded health plan on training wheels. It’s a step towards becoming fully self-funded without the full risk and commitment of making that leap. This is an attractive option for employers at approximately 50 employees, but can also be implemented for an employer with as few as five employees.

Claims data is a vital part to any hybrid funded health plan. It allows you to determine your business's claims history, to be able to properly plan a cost containment strategy with your benefit consultant for years ahead.

What are Captives and Consortiums ?

Captives and consortiums are collections of like-minded midsized employers that come together for the purpose of sharing risk and purchasing power as it relates to healthcare spending. Members save money on stop-loss insurance by pooling together and often see savings with favorable claims experience.

An employer’s participation in either of these products lends itself to sharing cost containment strategies with other members creating smart habits to lower your company’s overall health insurance expenses. Captives and consortiums are usually selective when it relates to which employers can join. The main (but not only) difference between them is that in most situations, captive participants must buy into the product with an initial investment. They then become part owners in the captive and may receive additional dividends back if the Stop Loss Insurance experience is favorable. These dividends may also have favorable tax treatment. Precision Benefits Group has relationships with both captives and consortiums and can place your firm with the product that suits your needs and risk profile.