Holistic employee benefits that take care of an individual’s diverse set of needs have become critical during COVID-19.

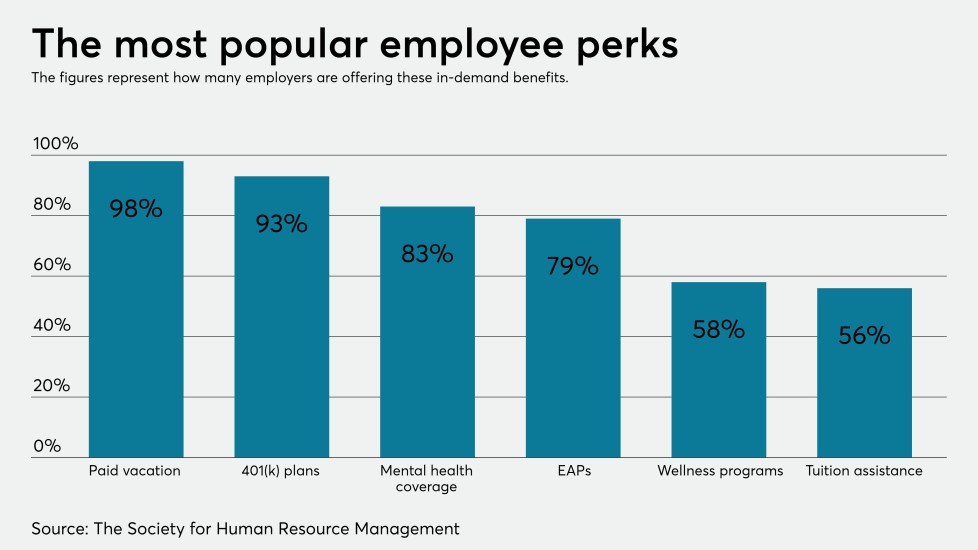

Employees are turning to their employers for support with challenges involving mental health, financial strain and childcare issues. Indeed, 58% of employers are offering their employees wellness benefits, according to data from the Society for Human Resource Management. Eighty-three percent of employers offer mental health coverage and 79% of employers offer an EAP.

“People are reconsidering and reevaluating their priorities,” says Dr. Natalie Baumgartner, chief workforce scientist at Achievers. “They’re looking at the way that their organization is supporting their well-being and the balance in their lives.”

About 41% of workers say they feel burned out and nearly a quarter say they are feeling symptoms of depression as a result of the pandemic, according to SHRM data.

“Balancing work and life activities this past year has been extremely difficult for many employees,” says Pattie Graves, a SHRM HR Knowledge Advisor. “Holistic benefits can greatly assist an employee’s mental health and well-being. Employers can use regular check-ins to gauge their employees’ needs and offer benefits that care for the whole individual.”

Healthcare and Flexible Spending Account Benefits

Historically, the flexible spending account has been a “use it or lose it” account, but a new law is allowing employees to hold on to their money for an additional year. The Consolidated Appropriations Act was passed by Congress and signed by President Trump in December. The legislation was designed to provide Americans with financial relief from the pandemic.

401(k) Plans

Retirement has always been an elusive goal for American workers. As markets fluctuate and employees’ financial needs evolve, traditional retirement plans aren’t enough to secure a worker’s financial future anymore. More than a third of workers have had to pull money from their retirement accounts in order to pay their bills, according to the Pew Research Center. Half of workers say the pandemic has made it more difficult to reach their long-term savings goals, Pew found. To help employees save for the long-term, employers need to help their workforce tackle their financial insecurity now.

Tuition Assistance

As the cost of higher education continues to explode, students are often faced with making a choice: go to school and struggle financially to bear the cost, or join the workforce. Many chose to work. Employers are uniquely positioned to offer support and provide employees with a benefit that will help them get a handle on their tuition and complete their education.

Paid Vacation

Employers understand how important it is for employees to unplug and recharge. Social distancing, lockdowns and remote work have all negatively impacted people’s mental health and interfered with their lives and the way they work. Depression can hinder a person’s ability to perform job tasks 20% of the time and reduces cognitive performance about 35% of the time, according to the Centers for Disease Control and Prevention. Even though travel options are limited due to the pandemic, it is important for employers to encourage employees to use their time off so they can rest their minds and improve their overall health.

Fitness and Gym Membership

Exercising regularly helps to promote health and could boost employee engagement, according to SHRM. Fifty-two percent of workers surveyed by SHRM claimed that they had more energy and felt more productive when participating in a physical wellness program.

Mental Health Coverage Benefits

While 96% of employers think they are doing enough to support employee mental health, just 69% of employees feel the same, according to a recent report by Ginger, a mental healthcare platform. Ninety-two percent of employers say they have increased their focus on mental health during the pandemic, but just 57% of employees agree. The pandemic has increased the focus on mental health as more employees struggle with depression, anxiety and high rates of burnout.

IVF Coverage and Infertility Treatments

The road to becoming a parent isn’t always easy. Making the decision to seek out fertility care can be emotionally and financially draining. Employers can help alleviate this burden through benefits that walk employees through the path to parenthood, creating a less stressed and more financially secure employee, leading to greater loyalty and productivity at work.

Paid Parental Leave

Flexible scheduling is just one part of the puzzle for employers wanting to support working parents. Companies that invest in employees and their families with benefits prioritizing their unique challenges see 5.5 times more revenue growth thanks to greater innovation, higher talent retention and increased productivity, according to research by Great Places to Work and Maven Clinic, a health services provider that supports women and families with their fertility, maternity, and pediatrics needs.

HSA

An HSA is one of the few accounts that allow employees to save for both retirement and healthcare expenses. Unlike an FSA, an employee can control the contributions into an HSA and can be rolled over to another HSA account if the employee changes jobs. The Consolidated Appropriations Act allows FSA balances to carry over into 2021 and be deposited into a qualifying HSA. Employers should be encouraging their workforce to take advantage of these savings.

EAP

EAPs have never been more relevant than they are today because employees and their families need mental health and work-life assistance. One thing we know for sure is that full service EAPs have proven their value. The 2020 Annual Report for the Workplace Outcome Suite measured the effectiveness of EAP counseling. The report found significant improvements in all five measures of work presenteeism, work engagement, workplace distress, work absenteeism and overall life satisfaction.

Long-term Care Insurance Benefits

The burden of caregiving affects employees in and out of the office: caregivers can experience emotional strain, financial challenges and economic risk, incurring steep out-of-pocket costs. The ratio of caregivers, which used to be 7:1 in 2010, has shrunk to 4:1, as people postpone parenting until later in life and have fewer children. The burden will become even heavier as the coronavirus crisis places further strain on caregivers.

Pet Insurance

With the increasing sophistication of veterinary medicine, animal healthcare costs are rising and there may be more of a need for employers to offer pet insurance, says Chris Middleton, senior vice president and general manager of insurance company Pets Best. About 45% of pet owners will spend the same or more on an animal’s healthcare than on their own, according to a Lendedu survey of 1,000 pet owners. Of those surveyed, 10% of pet owners say they had missed a payment on another bill in order to pay for petcare.

Wellness Programs

Employee wellness has been a major area of concern throughout the pandemic, as stress, depression and anxiety have plagued employees. December marked the lowest levels of employee well-being since the start of COVID-19, according to the Mental Health Index by Total Brain and the National Alliance of Healthcare Purchaser Coalitions. Wellness programs like exercising and financial assistance are increasing in popularity as employees seek ways to manage stress and build healthier habits during the pandemic.

(Article from Benefitnews.com By Amanda Schiavo)

Rob is an employee benefits expert with over 25 years of experience. He is the founder and principal of Precision Benefits Group, a leading provider of corporate benefits plans. He is a member of the Philadelphia Business Journal Leadership Trust and regularly contributes to the publication.